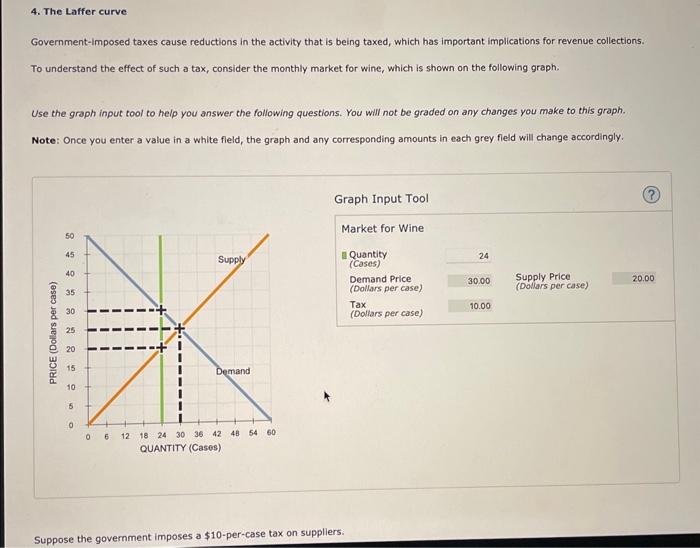

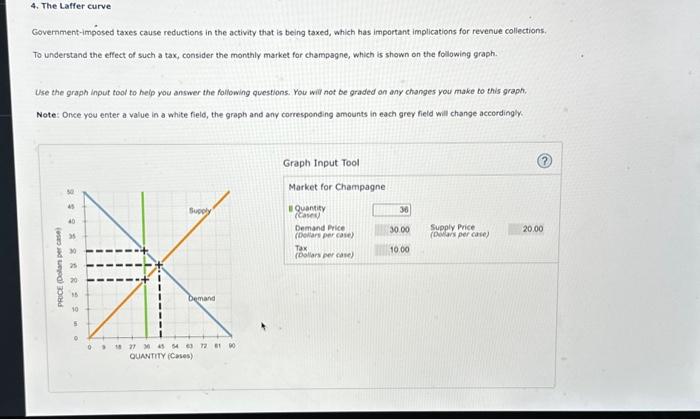

Suppose the government imposes a $10-per-case tax on suppliers: how will it impact the market dynamics and economic implications? This paper delves into the potential effects of such a tax, examining its impact on suppliers, consumers, and the overall market, while considering economic efficiency and distributional effects.

The analysis explores the potential consequences of the tax on suppliers’ revenue, profitability, and operations, as well as its impact on consumer prices and demand. It also examines the potential for market shifts, new entrants or exits, and changes in competition and market concentration.

Tax Impact on Suppliers: Suppose The Government Imposes A -per-case Tax On Suppliers

The imposition of a $10-per-case tax on suppliers can have significant consequences for their revenue, profitability, and operations. The tax directly reduces the amount of revenue suppliers receive for each case sold, as the tax is passed on to consumers.

This can result in lower overall revenue and profitability for suppliers.

In response to the tax, suppliers may adjust their pricing strategies or reduce production to mitigate the impact on their bottom line. Increasing prices can help offset the tax burden, but it may also lead to decreased demand from consumers.

Reducing production can reduce costs, but it can also limit the supply of goods and services in the market.

Tax Impact on Consumers

The $10-per-case tax can also have a noticeable impact on consumer prices. Suppliers typically pass on the tax to consumers, resulting in higher prices for goods and services. This can reduce consumer demand, as consumers may be less willing to purchase items that have become more expensive.

Consumers may also shift their purchases to untaxed or less-taxed alternatives. For example, if a tax is imposed on bottled water, consumers may switch to tap water or other beverages that are not subject to the tax. This can further reduce demand for taxed goods and services.

Market Dynamics, Suppose the government imposes a -per-case tax on suppliers

The tax can affect the overall market for the goods and services subject to the tax. The tax can create barriers to entry for new businesses, as they must factor in the cost of the tax into their operations. It can also lead to exits from the market, as existing businesses may find it difficult to compete with the increased costs.

The tax can also impact competition and market concentration. Larger suppliers may be better able to absorb the cost of the tax and pass it on to consumers without losing market share. This can lead to increased market concentration and reduced competition.

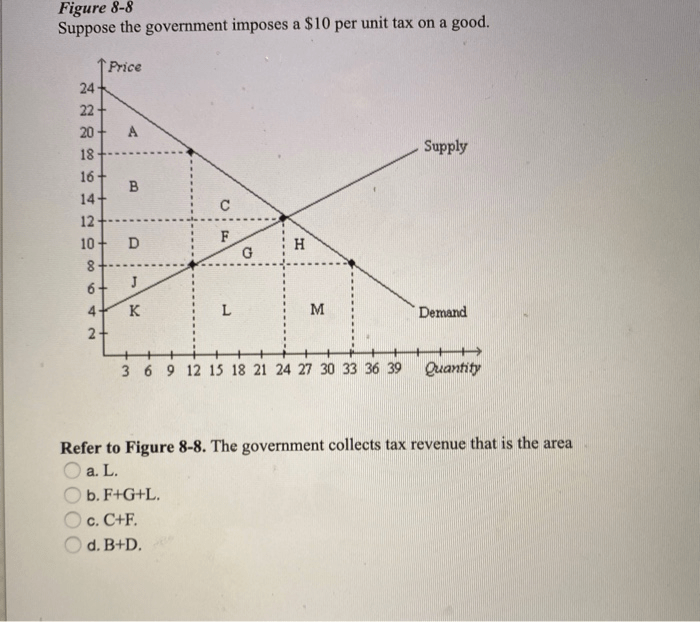

Economic Efficiency

The tax can lead to economic inefficiencies, such as deadweight loss. Deadweight loss occurs when the tax reduces the overall size of the market, as consumers are less willing to purchase taxed goods and services. This can result in a loss of consumer and producer surplus, as well as a reduction in overall economic welfare.

The tax can also lead to distortions in the market, as consumers and producers may make decisions based on the tax rather than on economic efficiency. For example, consumers may choose to purchase untaxed goods and services, even if they are of lower quality or less desirable than taxed goods and services.

Distributional Effects

The tax can have distributional effects, as it can impact different income groups or segments of the population differently. Low-income households may be disproportionately affected by the tax, as they spend a larger portion of their income on essential goods and services that are subject to the tax.

The tax can also exacerbate existing inequalities or create new ones. For example, if the tax is imposed on food, it can make it more difficult for low-income households to afford nutritious food. This can lead to health disparities and other negative consequences.

Policy Implications

The $10-per-case tax can have significant policy implications. It can be used as a revenue-generating measure or to achieve other policy objectives, such as reducing consumption of certain goods or services. However, it is important to consider the potential unintended consequences and trade-offs associated with the tax.

The tax may have unintended consequences, such as reducing overall economic activity or creating distortions in the market. It is important to carefully consider the potential costs and benefits of the tax before implementing it.

Essential FAQs

What is the primary objective of imposing a $10-per-case tax on suppliers?

The primary objective may vary depending on the specific policy context. Potential objectives include generating revenue, discouraging the consumption of certain goods or services, or influencing market behavior.

How might suppliers respond to the imposition of a $10-per-case tax?

Suppliers may respond by adjusting prices, reducing production, or seeking alternative markets. They may also engage in tax avoidance or evasion strategies.

What are the potential economic inefficiencies that may arise from the tax?

The tax may lead to deadweight loss, which occurs when the tax creates a gap between the price consumers are willing to pay and the price suppliers are willing to accept, resulting in a reduction in overall economic welfare.